Event organises need to manage GST obligations. If you've registered for GST, ensure that you incorporate the GST component when determining your ticket prices. All funds received (minus booking fees) will be transferred to you.

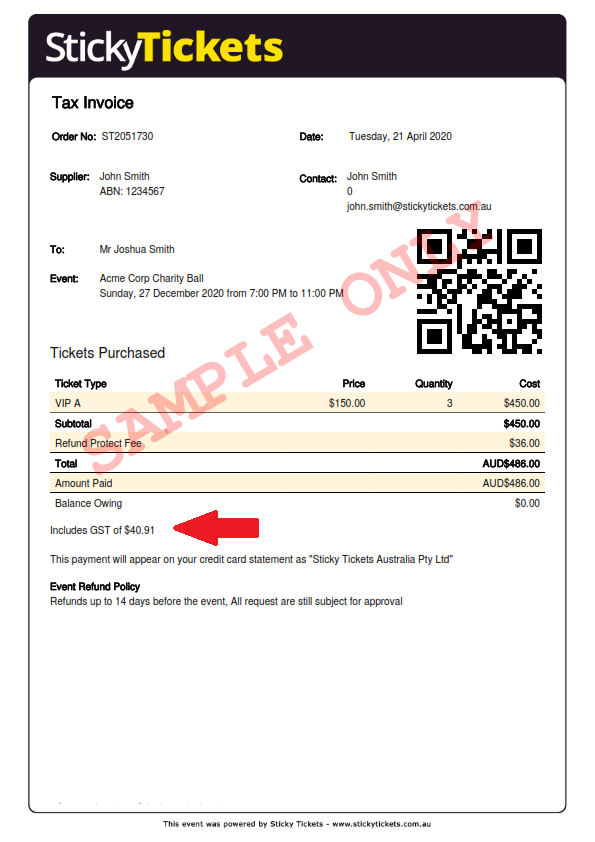

When a ticket is bought, the purchaser will receive a tax invoice detailing the GST portion of the ticket price if you've chosen "Registered for GST." If you haven't selected this option, the purchaser will receive a receipt stating that there is no GST included in the ticket price.

Please be aware that Sticky Tickets includes GST in the booking fee. After successfully concluding your event, you'll receive a receipt for the total booking fees paid, inclusive of GST. You can then claim this GST on your next Business Activity Statement (BAS).

If you have further questions or need assistance, feel free to reach out. We're here to help!