Can a Sticky Tickets receipt be used to claim a tax deduction?

In order to claim as a deduction, the donation must have been made to an approved organisation.

If the receipt was 100% a donation and you did not receive any goods or services, then the answer is yes, you can claim.

If your receipt was part donation and part for goods or services you received, then the receipt should indicate what portion of the payment is a donation, and only this portion is tax deductible.

Disclaimer: The above is general commentary and is based on information provided on the ATO website, please see the links below. We recommend that you seek advice from a tax professional before making a tax deductible claim or creating your event.

Australian Tax Office links

ATO Deductions for contributions relating to fund-raising events

NOTE to Event Organisers

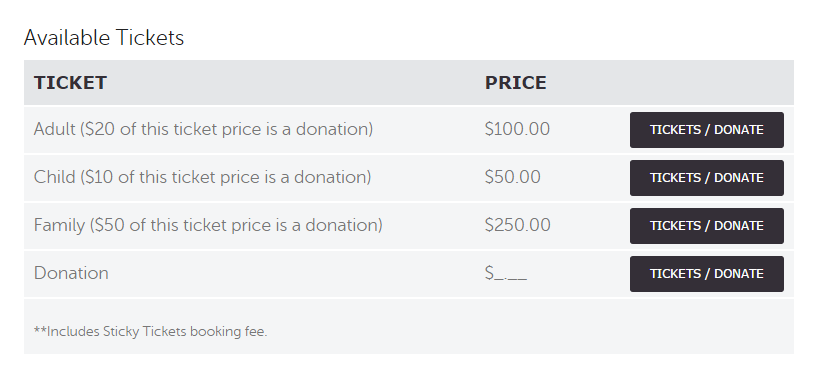

- When creating a ticket type that has a portion of the ticket price as a donation, you should include in the ticket description what portion is a donation

example ticket description

If you have any questions about this or any other topic, please contact us at support any time and we'd be more than happy to assist.